Money Discussion Forum

Money Discussion Forum

|

feeds feeds | |

| November 2024 | | Mon | Tue | Wed | Thu | Fri | Sat | Sun |

|---|

| | | | | 1 | 2 | 3 | | 4 | 5 | 6 | 7 | 8 | 9 | 10 | | 11 | 12 | 13 | 14 | 15 | 16 | 17 | | 18 | 19 | 20 | 21 | 22 | 23 | 24 | | 25 | 26 | 27 | 28 | 29 | 30 | |  Calendar Calendar |

|

|

| |

| Author | Message |

|---|

PALMFXMart

Pioneer Member

Posts : 22

Join date : 2018-07-10

|  Subject: Re: ForexMart's Forex News Subject: Re: ForexMart's Forex News  Wed Jul 18, 2018 11:37 am Wed Jul 18, 2018 11:37 am | |

Weak Income Growth In UK Despite High Employment Income growth in Britain showed down at its weakest rate in six months despite positive figures in record employment. This further adds concerns whether interest rates will be raised since the global financial crisis. Average weekly earnings grew by 2.5 percent on the year between the period of March and May at a lesser rate with 2.6 percent at three months earlier which was the lowest since September last year based on the report by the Office of National Statistics. Momentum picks up in the British economy after a sluggish first three months of the year due to heavy snow downfall and the central bank is considering being affected by the speed limit that would begin to raise the inflation rate. The BoE Governor Mark Carney mentioned that the economy as a whole, as well as, the pay is rising similar to the forecast in May that paves the way for a rate hike in August. Yet, a central bank deputy said that rising figure did not exceed the recent values of .5-3.0 percent range with the purpose of 3 percent growth rate by the end of the year. Also, according to him, there have been multiple ‘false dawns’ regarding the growth rate of the income where there could still be a spare storage in the labor market than the initial estimate of the central bank. There is also another record employment rate and the number of job openings has also reached a record new. Thus, it can be said the labor market is progressing steadfastly based on the reports, as described by the ONS statistician Matt Hughes. |

|   | | PALMFXMart

Pioneer Member

Posts : 22

Join date : 2018-07-10

|  Subject: Re: ForexMart's Forex News Subject: Re: ForexMart's Forex News  Thu Jul 19, 2018 12:12 pm Thu Jul 19, 2018 12:12 pm | |

NZ Economy Driven by Rural-Based Firms The provincial economies of New Zealand were able to drive economic growth, reinforcing the price recovery in the dairy products as mentioned by Infometrics chief forecast Gareth Kiernan on Wednesday. The regional spending activity was able to improve faster than the activity in the main centers. While prices for exports commodity remained at high levels. Moreover, the government’s simulatory fiscal policy also ease down the decline. Prior to the approval of the May Budget, the NZ expenditure options was restrained by the said policy which includes fees-free courses in tertiary education as well as the Families Package. Forecasts from the Treasury shows surplus growth by $7.3billion in 2022, with an expected increase in government revenue and the administration projected for a further boost in spending while keeping its records written. On the other hand, the lack of workers (skilled and unskilled) continue to hold back the NZ economic growth. Wage inflation expanded in the previous quarter and was able to trigger price pressure across the board for the next few years. In the provincial areas, issues about the lack of labor and effects of Mycoplasma bovis are the most critical problem in the main centers, as the world economy would likely weaken because of the trade dispute between the US and China. Low business reliance indicates that those companies who are domestically-centered were uncertain to hire or invest. Meanwhile, households were careful on their expenses due to higher oil prices and sluggish housing market. |

|   | | PALMFXMart

Pioneer Member

Posts : 22

Join date : 2018-07-10

|  Subject: Re: ForexMart's Forex News Subject: Re: ForexMart's Forex News  Fri Jul 20, 2018 11:36 am Fri Jul 20, 2018 11:36 am | |

US Leading Indicators Grew by 0.5% in June The Leading Economic Index by the Conference Board was able to expand by a half percent this month, showing a higher than expected figures. The indicator had increased by 0.5 percent in June which beat the forecast of 0.4 percent growth based on the Reuters’ poll. The boost marks the eighth consecutive month of improvement for the index. Ataman Ozyildirim, Director of Business Cycles and Growth Research at The Conference Board, stated that the US LEI rose due to the continued stable growth in the American economy. He added that the overall strengthening in leading indicators, except the housing permits which decreased again, does not indicate any significant slowdown in the near-term. The flat reading in the month of May suggested that the economic performance will remain strong but will not move higher as shown in the Conference Board's report. The measurement evaluates the US economic conditions and the outlook of world economic trends. Furthermore, the Conference Board imposed a composite value based on 10 key metrics which includes the average weekly unemployment claims, producers’ new orders and stock prices. |

|   | | PALMFXMart

Pioneer Member

Posts : 22

Join date : 2018-07-10

|  Subject: Re: ForexMart's Forex News Subject: Re: ForexMart's Forex News  Mon Jul 23, 2018 12:10 pm Mon Jul 23, 2018 12:10 pm | |

Germany Imposed Export Limit Against Turkey Germany increased its economic sanctions against Turkey and eased down its travel advisory as Ankara’s two-year state of emergency ended. The report from the newspaper Frankfurter Allgemeine Zeitung confirmed that the export limit worth 1.5 billion-euro ($1.7bn) ensures Turkey cannot be renewed for this year according to the German economy ministry. The assessment was introduced in July 2017 in order to constraint Turkey due to the arrest of five German activists and a German human rights campaigner which further includes the leader of Amnesty International in Turkey. The opposing blocs in Germany denounce that the limit was too weak since the value of export guarantees boosted from 1.1bn euros in 2016 to 1.46bn euros next year. |

|   | | PALMFXMart

Pioneer Member

Posts : 22

Join date : 2018-07-10

|  Subject: Re: ForexMart's Forex News Subject: Re: ForexMart's Forex News  Tue Jul 24, 2018 11:57 am Tue Jul 24, 2018 11:57 am | |

Eurozone’s Steady Growth of Consumer Confidence in July Consumer confidence in the eurozone remained the same in July, signifying steadfast growth in the third quarter based on the data published on Monday. According to the European Commission, the flash estimate of the eurozone consumer morale was kept unchanged at -0.6 points in July. Meanwhile, the data for June was adjusted lower from the earlier figure of -0.5 to 0.6. As for the general consumer sentiment in the European Union, a significant increase in the result to -0.7 with 0.6 points difference from the previous data. Yet, economists are still optimistic of growth to continue by the second half of the year amid the weakened status in the second quarter. Forecast of the European Central Bank says growth will be 2.1 percent this year in the whole eurozone. |

|   | | PALMFXMart

Pioneer Member

Posts : 22

Join date : 2018-07-10

|  Subject: Re: ForexMart's Forex News Subject: Re: ForexMart's Forex News  Wed Jul 25, 2018 11:23 am Wed Jul 25, 2018 11:23 am | |

India and Uganda to Boost Defense Ties India and Uganda made a deal to expand bilateral cooperation in terms of defense and economy after the delegation-level talks between Ugandan President Yoweri Museveni and Prime Minister Narendra Modi on Tuesday. India further expanded two lines of credit in agriculture, dairy sectors, energy and infrastructure amounted USD 200 million to Uganda and PM Modi had comprehensive discussions with Museveni about the ways to strengthen bilateral agreements. According to the Indian leader, the arrangement lies within the great contentment and development of defense effort between the two nations. While Museveni stated that both countries were focused on investment, trade, and tourism. Also, Modi suggested that Indian firms will invest in Uganda’s healthcare industry. |

|   | | PALMFXMart

Pioneer Member

Posts : 22

Join date : 2018-07-10

|  Subject: Re: ForexMart's Forex News Subject: Re: ForexMart's Forex News  Thu Jul 26, 2018 12:00 pm Thu Jul 26, 2018 12:00 pm | |

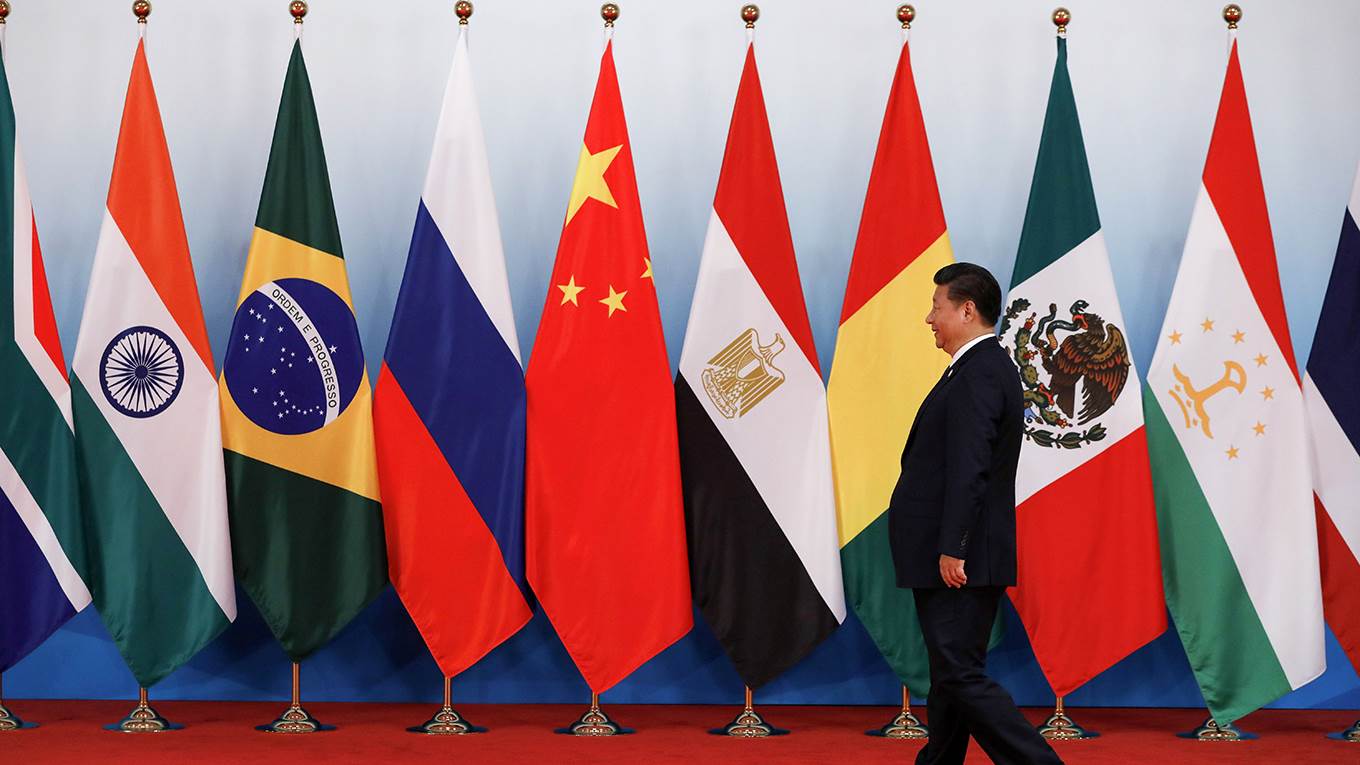

“No Winner” in Trade Battle, says China The BRICS (Brazil, Russia, India, China and South Africa) leaders will have a three-day meeting in Johannesburg, South Africa. According to China, no nation could be declared as the winner in the global trade dispute, as Chinese President Xi Jinping appealed to the developing countries to refuse protectionism. While South African President Cyril Ramaphosa cautioned about the effect of tariff threats by the American President Donald Trump. The BRICS consists of more than 40% of the world population but never work together as a coordinated economic bloc. Furthermore, Xi stated that the consolidated expansion of developing countries and emerging market is continuous and will balance more the global growth. In the previous week, Trump spoke that he was ready to set upon $500bn worth of tariffs on all imported Chinese goods. While South Africa is currently suffering from collateral damage due to US tariffs on steel and aluminum which affects 7,000 jobs, said the country’s Trade Minister Rob Davies. And the attempt to impose an exemption from the US administration ended up failing. There were 22 more countries expected to participate in the summit this week, 19 of them is from Africa. China pledged $14.7bn worth of investments to South Africa, according to the announcement of President Ramaphosa after the opening ceremony. |

|   | | PALMFXMart

Pioneer Member

Posts : 22

Join date : 2018-07-10

|  Subject: Re: ForexMart's Forex News Subject: Re: ForexMart's Forex News  Fri Jul 27, 2018 12:03 pm Fri Jul 27, 2018 12:03 pm | |

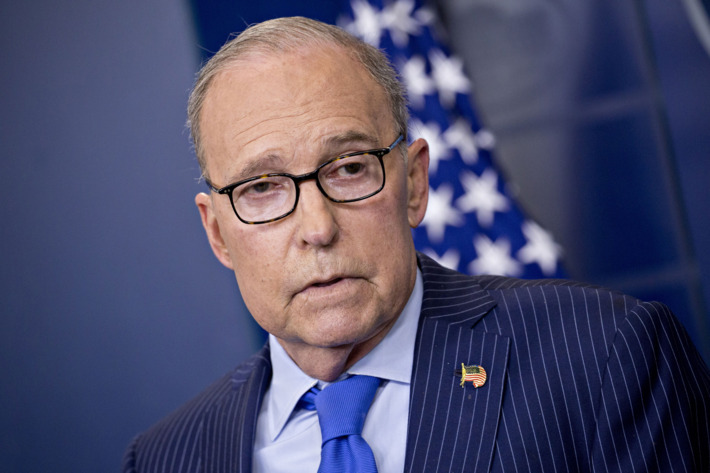

U.S. GDP to Grow Significantly, says Econ Advisor Kudlow U.S. economic advisor Larry Kudlow anticipates that the GDP for the second quarter will have a maximum raise. Kudlow was unable to give the specific figures, however, he contradicted the expected range of 4 to 4.5 percent. Moreover, the head of National Economic Council is the most recent official to discuss his viewpoint on economic data prior its publication, which infrequently happens in the White House. Earlier in June, American President Donald Trump posted on Twitter about his anticipation for the release of the May nonfarm payrolls report, an hour prior the publication. Based on the Reuters survey, economists predicts that the quarterly GDP will reach 4.1 percent for the initial reading. In case that the growth rate will gain 5.2 percent, this can be regarded as the best single-quarter projection since Q3 of 2014 which is also the most significant increase during the presidency of Barack Obama. Hence, the forecasts continue to show different numbers, as CNBC Rapid Update survey of top economists foresees 4.2 percent expansion and Barclays speculates for a 5.2 percent increase. On the other hand, the New York Fed assumes for a 2.7 percent low end while the Atlanta Fed stands at 3.8 percent. |

|   | | PALMFXMart

Pioneer Member

Posts : 22

Join date : 2018-07-10

|  Subject: Re: ForexMart's Forex News Subject: Re: ForexMart's Forex News  Mon Jul 30, 2018 12:08 pm Mon Jul 30, 2018 12:08 pm | |

US Economy to Gain 3pc, says Mnuchin US Treasury Secretary Steven Mnuchin stated his growth outlook for the American economy, he mentioned that the United States is heading for a 3 percent annual increase for many years. Mnuchin further expressed that it is easy to predict potential earnings for the upcoming years, however, he deems that the ongoing growth supported itself for the next four or five years. He also said that the current administration concentrates on long-term and well-maintained economic performance, as their proposed plans were achieved. This was seen after the 4.1 percent Friday’s GDP report for the second quarter of this year. |

|   | | PALMFXMart

Pioneer Member

Posts : 22

Join date : 2018-07-10

|  Subject: Re: ForexMart's Forex News Subject: Re: ForexMart's Forex News  Tue Jul 31, 2018 12:21 pm Tue Jul 31, 2018 12:21 pm | |

UK Interest Rates Predicted to Grow This Week The survey on top economists shows that experts are expecting for the Bank of England to lift its interest rates to 0.25% on Thursday, which would likely put pressure towards house hunters. Based on the poll of the Finder.com on Monday, there were nine economists who agreed that the Monetary Policy Committee will increase its rates during the Thursday’s meeting. The personal finance site mentioned that it’s the first time for the unanimous votes by experts in terms of the interest rates direction since 2007, while they have various responses about the effect of the predicted hike and further economic indicators. Moreover, the economic figures indicate increasing wages and lesser unemployment rate influences the projected percentage hikes. Nevertheless, homebuyers anticipate for a bounce in their budgets due to wage growth offset led by the mounting costs on mortgages. One-third of the polled economists expressed pessimism towards housing affordability. Also on Monday, the economic research consultancy Pantheon Macroeconomics further projected a raise on Thursday and stated that there could possibly rate hikes in 2019. |

|   | | PALMFXMart

Pioneer Member

Posts : 22

Join date : 2018-07-10

|  Subject: Re: ForexMart's Forex News Subject: Re: ForexMart's Forex News  Wed Aug 01, 2018 12:11 pm Wed Aug 01, 2018 12:11 pm | |

S. Korea Factory Activity Slump for Five Months in a Row The factory activity of South Korea declined for the fifth time in July and recorded as the worst drop since November 2016. While new orders and output fell as shown in the private manufacturing poll on Wednesday. The Nikkei/Markit purchasing managers’ index (PMI) had a downturn to 20-month low at 48.3 last month, compared to June’s 49.8 and remained to be lower than the 50-point mark that separates growth from contraction since March 2018. The manufacturing activity was affected by the new orders and output and slumped to its 3-month lows at 47.8 and 47.3, respectively. Furthermore, the data showed that the business confidence shrunk to ten-month low due to gloomy conditions. The output reading indicates notable weakness in the production figures for the month of June. On the other hand, the instability in domestic demand occurred during the intensive global growth uncertainties as the international trade conflict threatens to affect economies that primarily rely on exports. The sub-index for new export orders had decreased from 52.9 on June to 50.1 in July, which gave hints for the potential marginal increase in new foreign businesses and if such trend will continue, the economic growth might get hurt. South Korea was also afflicted by the war between the United States and China, as their largest export market, and this further heightened the risks for transport manufacturers. |

|   | | PALMFXMart

Pioneer Member

Posts : 22

Join date : 2018-07-10

|  Subject: Re: ForexMart's Forex News Subject: Re: ForexMart's Forex News  Thu Aug 02, 2018 11:50 am Thu Aug 02, 2018 11:50 am | |

German Factory Output Pick up in July, says PMI According to a survey on Wednesday, stronger new orders and increased in output supported the development in German manufacturing industry for July. Markit’s Purchasing Managers’ Index (PMI) for manufacturing comprises one-fifth of the economy and expanded to 56.9 versus 55.9 in June. Moreover, the July reading coincided with the May’s figures and higher than the 50 line that separates growth from contraction. The figure was below than flash reading of 57.3. Germany’s economy was able to gain momentum following a soft patch during the first four months of 2018, but the forecasts appear to indecisive due to trade conflict issues. IHS Markit revealed that firms remain optimistic, showing that the level of positivity for the future surge since April.. |

|   | | PALMFXMart

Pioneer Member

Posts : 22

Join date : 2018-07-10

|  Subject: Re: ForexMart's Forex News Subject: Re: ForexMart's Forex News  Mon Aug 06, 2018 11:20 am Mon Aug 06, 2018 11:20 am | |

Singapore GDP Growth Down to 3.8%, says MTI The economic report of Singapore for the second quarter of the year is expected to be release on Monday, Aug 13, at 8am, according to the Ministry of Trade and Industry (MTI). The survey will further show the final economic growth data for Q2 which includes comprehensive details about employment, growth sources, inflation, productivity, and sectoral performances. While last month, the forecasts indicated that Singapore's economic growth declined to a one-year low of 3.8 percent in April to June quarter due to escalation of trade uncertainties and slackening manufacturing sector. The expectation came in weaker than market outlook and lower than the 4.3 percent expansion reported in the first quarter this year. Nevertheless, economists remained consistent with their growth outlook for the whole year despite the remarkably downside risks on the back of increasing tensions between the US and China and the recent property cooling measures. According to the central bank of the country, Monetary Authority of Singapore (MAS), the economy is projected to keep a "steady expansion path" last month amid the headwinds brought by trade wars. While in May, the MTI reduced the range estimate for Singapore's annual growth between 2.5 and 3.5 percent. |

|   | | PALMFXMart

Pioneer Member

Posts : 22

Join date : 2018-07-10

|  Subject: Re: ForexMart's Forex News Subject: Re: ForexMart's Forex News  Tue Aug 07, 2018 11:33 am Tue Aug 07, 2018 11:33 am | |

Japan Wage Growth Makes Significant Increase Wages for workers in Japan had a significant increase in June due to the huge amount of summer bonuses. With this, the people were able to control their money despite the decline of household expenditure for five consecutive months. Moreover, labor cash earnings increased by 3.6 percent in June 2017 against expected +1.7 percent. Real wages, on the other hand, were adjusted for inflation and showed growth of 2.8 percent versus the forecast of +0.9 percent. Since Japan was supported by the tightest labor markets for decades, wages had a steady growth path since mid-2017 and real wages also begin to rise. This is a favorable news for the central bank of Japan, as the BOJ recently adjusted their monetary policy to sustain the easing programme. Families will be willing to have higher spending if they were convinced about the continuous pay hikes, which could prompt prices to increase as well as the economic growth development. However, the problem lies with the employers who tend to raise bonuses rather than imply permanent wage hike. |

|   | | PALMFXMart

Pioneer Member

Posts : 22

Join date : 2018-07-10

|  Subject: Re: ForexMart's Forex News Subject: Re: ForexMart's Forex News  Wed Aug 08, 2018 12:14 pm Wed Aug 08, 2018 12:14 pm | |

South Korea Slow Economic Recovery due to Weak Domestic Demand The economic recovery of South Korea was restricted by the sluggish domestic demand despite the positive exports, as mentioned by an economic think tank on Tuesday. In a monthly report from the Korea Development Institute (KDI), exports sustained its optimistic growth on demand for locally produced semiconductors. However, the KDI mentioned that domestic demand slightly softened alongside the lagging recovery in consumer expenditure and fluctuation in corporate investment. While the production recovery was affected by the trend and cooled down aside for several sectors such as the chip industry. Moreover, S. Korea’s retail sales grew by 4 percent in June but below than 4.5 percent expansion in July. While consumer sentiment index versus the economic status contracted to 101.0 in July from 105.5 in the previous month. |

|   | | PALMFXMart

Pioneer Member

Posts : 22

Join date : 2018-07-10

|  Subject: Re: ForexMart's Forex News Subject: Re: ForexMart's Forex News  Fri Aug 10, 2018 11:01 am Fri Aug 10, 2018 11:01 am | |

UK GDP Outlook for Q2 Expected to Double Q1’s Rate The Gross Domestic Product (GDP) growth rate of the United Kingdom for the April- June quarter is predicted to double the Q1’s rate with an increase of 0.4 percent. The report is scheduled to be released on Friday, August 10 at 8:30 GMT by the Office for National Statistics. Compared last year, the UK GDP for the second quarter is projected to grow by 1.3 which is higher than the 1.2 percent growth rate in the first quarter of 2018. The recovery of Britain’s GDP rate to an increasing momentum from the near-zero level combined with the recent reports of the EU in settling the Brexit deal for the UK Prime Minister Theresa May are both intended to cool down the selling pressure of the GBP after its decline to 1.2841 yesterday. Moreover, the overall development is expected and the British economy sustained its position well below the average growth rate outlook for major advanced countries, considering that Brexit risks affect the expenditure and business investment decisions. The initial forecast of the National Institute of Economic and Social Research (NIESR) for the UK GDP was issued and showed that the research institute’s GDP Tracker indicates an expansion of 0.4 percent in Q2 of this year and 0.5 percent in Q3. The policymakers of the Bank of England also shows optimism towards the UK, stating that growth would likely remain discreet based on its historical standards but relatively higher than the beginning of this year. |

|   | | PALMFXMart

Pioneer Member

Posts : 22

Join date : 2018-07-10

|  Subject: Re: ForexMart's Forex News Subject: Re: ForexMart's Forex News  Tue Aug 14, 2018 11:39 am Tue Aug 14, 2018 11:39 am | |

US Economy Rose to 3.1 pc: CBO The American economy is expected to boost by 3.1 percent this year due to increase in government expenditure and tax reductions supported the growth, according to the Congressional Budget Office yesterday. However, the strong expansion may slow down earlier in 2019 considering that the United States may weaken as temporary government policies may elapse based on CBO’s report. Moreover, the Congressional Budget Office predicted showed that the economic growth will decline to 2.4 percent next year and 1.7 percent in 2020, hovering above that level on the following decade. In case that CBO’s figures coincided with the results, the US economy would likely leap to 3.1 percent this year versus 2.6 percent last year. The mentioned numbers indicate a significant development amid the impact of the Great Recession, with a slackening annual growth rate of 2.2 percent. |

|   | | PALMFXMart

Pioneer Member

Posts : 22

Join date : 2018-07-10

|  Subject: Re: ForexMart's Forex News Subject: Re: ForexMart's Forex News  Wed Aug 15, 2018 11:54 am Wed Aug 15, 2018 11:54 am | |

Strong Dollar Curbs Inflation, Drop in U.S import prices Import costs of the U.S. were kept the same in July with the surge of fuel costs that balanced out weak prices on other aspects, implying keeping an eye to inflation due to a strong dollar. The flat reading of import prices revised upwardly to 0.1 percent decline in June as reported by the Labor Department on Tuesday. A decline of import prices by 0.4 percent in June. Reuters survey of economists is an increase of 0.1 percent in July. Twelve months after, import price grew to 4.8 percent, the highest gain since February 2012, following a rise of 4.7 percent in June. In the previous month, imported fuels and lubricants rose by 1.6 percent from 1.3 percent increase in June. On the other hand, food costs decline by 1.8 percent from 2.6 drop in June. As for imports prices, excluding fuels and foods, it slid down by 0.1 percent in July after a drop of 0.2 percent last month. Core import prices grew by 1.6 percent in 1 year from July. The dollar grew 0.5 percent compared to other main trading partners in July and further strengthen by 4 percent on a trade-weighted basis this year, which could affect the expected increase of import goods prices in the background of tension between global major economies and America. Tariffs on steel and aluminum imposed by the Trump administration to protect the domestic business that was seen to be performing unevenly to the foreign competitors. Consequently, their major trading partners such as the E.U., China, Canada, and Mexico responded the same way with their tariffs. |

|   | | KostiaForexMart

Super Stars

Posts : 1580

Join date : 2019-03-22

|  Subject: Re: ForexMart's Forex News Subject: Re: ForexMart's Forex News  Fri Nov 08, 2019 9:07 pm Fri Nov 08, 2019 9:07 pm | |

08.11. Gold shows worst indicators in two yearsGold prices continue to show the worst performance over the past two years, responding to positive news on the settlement of trade differences between the US and China. Today, gold futures for December delivery fell to $1,457.10 per troy ounce, plummeting from the $1,493 area. Such lows were the biggest loss since 2017. The pressure on the precious metal was exerted by news about the mutual abolition of US and Chinese duties. The elimination of duties is one of the main conditions for concluding the first stage of a trade deal. Success in negotiations supports the full range of risky assets, and gold, as a rule, moves in the opposite direction from risk. Additional pressure on gold was exerted by the news that the People's Bank of China, being a constant accumulator of gold bullion, was not able to replenish its reserves again in October.  |

|   | | KostiaForexMart

Super Stars

Posts : 1580

Join date : 2019-03-22

|  Subject: Re: ForexMart's Forex News Subject: Re: ForexMart's Forex News  Mon Nov 11, 2019 7:54 pm Mon Nov 11, 2019 7:54 pm | |

11.11. Oman believes non-OPEC will extend the deal to reduce oil productionOman’s energy minister Mohammed bin Hamad al-Rumhy said today, that OPEC and non-OPEC producers will probably extend a deal to limit crude supply, but the oil production will be kept at the current level (1.2 million barrels per day). The minister also noted, that oil demand was improving lately as trade tensions soften and that Oman was satisfied with current oil prices. The Organization of Petroleum Exporting Countries (OPEC), Russia and other allies have agreed since January to reduce oil production by 1.2 million barrels per day to maintain the market. Nowadays the experts see signs of improvement in the situation with balance of demand and supply in the oil market, fear of recession is getting lower, and optimistic signals about a trade agreement between the US and China make unnecessary the further reducing measures.  |

|   | | KostiaForexMart

Super Stars

Posts : 1580

Join date : 2019-03-22

|  Subject: Re: ForexMart's Forex News Subject: Re: ForexMart's Forex News  Tue Nov 12, 2019 7:31 pm Tue Nov 12, 2019 7:31 pm | |

12.11. The world’s largest trade deal could be signed in 2020After more than 6 years of negotiations, a group of 15 Asia-Pacific countries is going to sign the the world’s largest trade agreement in 2020. The deal is called Regional Comprehensive Economic Partnership (RCEP) and it will involve all 10 countries from the Association of Southeast Asian Nations (ASEAN) bloc and five of its major trading partners: Australia, China, Japan, New Zealand and South Korea. The United States are not to be the joiner to the RCEP. Initially India planned to join the mega-deal, but later decided to abstain from participation in trade pact over concerns that it would hurt domestic producers. In any case, the 15 member-countries make up close to one-third of the world population and global gross domestic product. So, the uniting within the RCEP would boost trade throughout the group by reducing tariffs, standardizing customs rules and procedures and expanding market access, especially among countries that have not concluded trade agreements.  |

|   | | KostiaForexMart

Super Stars

Posts : 1580

Join date : 2019-03-22

|  Subject: Re: ForexMart's Forex News Subject: Re: ForexMart's Forex News  Wed Nov 13, 2019 7:32 pm Wed Nov 13, 2019 7:32 pm | |

13.11. The results of D. Trump’s speech at the Economic Club of New YorkYesterday in a speech to the Economic Club of New York US President Donald Trump announced the «imminent» prospects of completing the first phase of the trade deal with China, but did not provide any new details about the talks. The president’s speech disappointed investors, as they awaited any important political statements to be made. But Trump didn’t announce the place and date of signing a trade deal with Chinese President Xi Jinping, as it was expected before. Instead of this American president threaten to «very substantially» raise tariffs on Chinese goods if China does not make a deal with the United States. Along with this Trump noted, that the US would only accept the deal if it served the interests of his country, American employees and companies. The biggest part of president’s speech was devoted to success of White House administration. Trump said his staff had worked hard to bolster the economy despite of «too many interest rate hikes by the Federal Reserve».  |

|   | | KostiaForexMart

Super Stars

Posts : 1580

Join date : 2019-03-22

|  Subject: Re: ForexMart's Forex News Subject: Re: ForexMart's Forex News  Tue Nov 19, 2019 9:03 pm Tue Nov 19, 2019 9:03 pm | |

19.11. Global stocks hit two-year highsToday world stocks reached two-year highs, as investors still believe that the US and China will be able to close a deal and put an end to a destructive trade war. The two largest economies in the world are negotiating a deal, which must end the 18-month trade conflict that shook global markets, but at the same time Washington is intending to introduce additional duties on Chinese goods on December 15. Despite the lack of clarity on the progress of the talks, investors are encouraged by the growing hopes to reduce recession risks. Moreover, monetary easing by large central banks, such as China, has also helped to strengthen investors sentiment towards stocks. Thereby, the global MSCI index, which tracks stocks in 47 countries, added 0.1%, reaching the highest level since last January. European stocks also rose: Euro STOXX 600 added 0.4%, peaking since July 2015. Indices in Frankfurt (GDAXI) and London (FTSE) rose 0.4% and 0.5%, respectively. Futures on Wall Street (ESc1) also showed a positive start, adding 0.2%.  |

|   | | KostiaForexMart

Super Stars

Posts : 1580

Join date : 2019-03-22

|  Subject: Re: ForexMart's Forex News Subject: Re: ForexMart's Forex News  Wed Nov 20, 2019 8:34 pm Wed Nov 20, 2019 8:34 pm | |

20.11. Trump says China tariffs will go «even higher» without dealOn Wednesday, American futures fell after US President Donald Trump again threatened to increase duties on Chinese goods if the parties did not sign a trade deal in the near future. «If we don’t make a deal with China on our terms, I will raise the tariffs even higher», – Trump told reporters at the meeting in the White House. Trump’s message frightened investors and made them turn to defensive assets. Moreover the most of US futures showed decline. In particular, the Nasdaq 100 index fell 41 points or 0.5%, Dow futures lost 103 points or 0.4%, and S&P 500 futures fell 10 points or 0.4%. Urban Outfitters Inc shares fell 16.1%, Pacific Gas lost 4.7% at the premarket, while Micron shares declined by 1.3%.  |

|   | | KostiaForexMart

Super Stars

Posts : 1580

Join date : 2019-03-22

|  Subject: Re: ForexMart's Forex News Subject: Re: ForexMart's Forex News  Thu Nov 21, 2019 7:44 pm Thu Nov 21, 2019 7:44 pm | |

21.11. Russia expects Nord Stream 2 to begin operations in mid-2020Deputy Prime Minister Dmitry Kozak said that Russia’s Nord Stream-2 gas pipeline is expected to begin operations in mid-2020, despite opposition from some European countries and the United States. The States affirm that the gas project will increase Europe’s dependence on Russian gas, which runs counter to the interests of the White House. As a result, the United States were putting pressure on European countries to slow down the Russian project. For example, Denmark issued a permit to build a gas pipeline in the country's exclusive economic zone only at the end of October. Earlier, the Russian president called on the Danish authorities not to succumb to pressure from the United States and to defend their sovereignty. Recall that Nord Stream-2 will run along the bottom of the Baltic Sea from the coast of Russia to the coast of Germany. The throughput of the pipe is 55 billion cubic meters of gas per year. The project cost is estimated at 10 billion euros.  |

|   | | Sponsored content

|  Subject: Re: ForexMart's Forex News Subject: Re: ForexMart's Forex News  | |

|

|   | | |

Similar topics |  |

|

| | Permissions in this forum: | You cannot reply to topics in this forum

| |

| |

| |