Money Discussion Forum

Money Discussion Forum

|

feeds feeds | |

| May 2024 | | Mon | Tue | Wed | Thu | Fri | Sat | Sun |

|---|

| | | 1 | 2 | 3 | 4 | 5 | | 6 | 7 | 8 | 9 | 10 | 11 | 12 | | 13 | 14 | 15 | 16 | 17 | 18 | 19 | | 20 | 21 | 22 | 23 | 24 | 25 | 26 | | 27 | 28 | 29 | 30 | 31 | | |  Calendar Calendar |

|

| | | Daily Market Analysis from ForexMart |    |

| |

| Author | Message |

|---|

Andrea ForexMart

Senior Member

Posts : 216

Join date : 2017-08-23

|  Subject: Daily Market Analysis from ForexMart Subject: Daily Market Analysis from ForexMart  Wed Aug 23, 2017 7:30 am Wed Aug 23, 2017 7:30 am | |

Hello forum members!

Good day!

I am Andrea, an official representative of ForexMart.

Me and my colleagues will provide you daily forex analysis on this thread to help you increase your trading efficiency as well as maximizing your profit. Suggestions, comments or opinions are all welcome. We will also be glad to attend to your inquiries.

We hope to hear from you soon!

Thank you!

Best regards,

ForexMart |

|   | | Andrea ForexMart

Senior Member

Posts : 216

Join date : 2017-08-23

|  Subject: GBP/JPY Technical Analysis: August 23, 2017 Subject: GBP/JPY Technical Analysis: August 23, 2017  Wed Aug 23, 2017 2:15 pm Wed Aug 23, 2017 2:15 pm | |

The British pound against the Japanese yen surged at the beginning of the Tuesday session although there has been difficulty in the former uptrend line which has a breakout recently around the level of 141. Hereinafter, they have been moving in a bullish stance. The 140 level will most likely be the support level with a bit of consolidation with a negative tone.

Although the Japanese yen has been weaker during the trading session, the pound has been moving in a similar way that lessens the risk of the pair to collapse. There was a fresh, new low signals selling of the pair. If the pair breaks over the 141 handle, there would be a bullish sentiment.

The market is sensitive for a risk appetite which would induce the market reaction to the stock markets, commodities, and other markets. It won’t take long before the market left and if this persists to rise but there is still a risk with the Brexit process. The volatility will return to the market soon. Trades have to careful of the weakened market condition which could pose a problem in trading. |

|   | | Andrea ForexMart

Senior Member

Posts : 216

Join date : 2017-08-23

|  Subject: EUR/USD Technical Analysis: August 24, 2017 Subject: EUR/USD Technical Analysis: August 24, 2017  Thu Aug 24, 2017 2:09 pm Thu Aug 24, 2017 2:09 pm | |

The EUR/USD pair had a calm trading session on Wednesday. Soon after it climbed much higher with a bullish overall sentiment in the market. Overall, it is not surprising that the U.S. dollar is continuously sold. The manufacturing data from the European Union would not have any effect to the pair as it came out positively.

Considering the long-term charts, there is a bullish trend that is about to begin. Also, the ECB President Mario Draghi did not mention the value of the currency and it seems like that the central bank does not keep track of the value of the currency. If this is the case, the bullish tone of the pair will most likely continue especially if Janet Yellen gave off a slightly dovish hint on Friday.

The market will continue to buy on the lows which will significantly give more support. The 1.17 level positions as the support of the market and if the pair could maintain its level above the said level, the price could further go up. On the other hand, the 1.20 level gives off a significant resistance and an increase in momentum is already expected to reach the target level.

Meanwhile, it is possible that the market will buy short-term dips to raise a bigger position since a breakout occurred recently above the consolidation in the past few years that could soar the price up towards 1.25 level. Long-term trades would support the euro and selling of the U.S. dollar. However, it would be best to wait and consider the whole situation if a breakdown lower than the 1.17 level occurs. |

|   | | Andrea ForexMart

Senior Member

Posts : 216

Join date : 2017-08-23

|  Subject: USD/JPY Technical Analysis: August 25, 2017 Subject: USD/JPY Technical Analysis: August 25, 2017  Sat Aug 26, 2017 12:39 pm Sat Aug 26, 2017 12:39 pm | |

The U.S. dollar paired against the Japanese yen rallied on Thursday session as it reached the 109.50 level. However, the event related to the random tweets of the president reversed the situation and people are anxious on the budget issues in the United States. This resulted in simple noise which happens every now and then and turned around at a faster rate. The most awaited speech from Janet Yellen in Jackson Hole which would give a hint the outlook of the Fed regarding the economy. A hawkish sentiment would support the dollar and push it much higher. However, if she gives a dovish tone instead, this pair would plunge lower. |

|   | | Andrea ForexMart

Senior Member

Posts : 216

Join date : 2017-08-23

|  Subject: GBP/USD Fundamental Analysis: August 30, 2017 Subject: GBP/USD Fundamental Analysis: August 30, 2017  Thu Aug 31, 2017 8:24 am Thu Aug 31, 2017 8:24 am | |

The pound-dollar pair followed a pattern made by the single European currency and closed the day unchanged despite the high level of volatility throughout the day. Yesterday morning, we witnessed the weakening of the dollar that helped the GBPUSD to drove above the region 1.2950. Later the day, the strength of the greens returned and the Cable corrected under the 1.2950 level and ended the day unchanged.

The London market was able to have its initial reaction regarding the remarks of Yellen and Draghi last Friday. According to expectations, their reactions are focused to the dollar selling across the board.

Yellen did not provide support for the dollar amid its sluggish stance, hence this signaled traders to sell the USD. This assisted the pair to reach the 1.2950 zone and further drove near 1.30, however, stalled due to heavy selling. It leads to pair’s correction which helped to touch the 1.2920 support region as of the moment.

As the month nearly ends, the month end currency flows is expected which could influence the sterling in the near-term. In respect to the ongoing negotiations of Brexit, risks are also anticipated to put pressure on the GBP. however, as the greenbacks continue to weaken, the Cable would likely have extra support to ascend to 1.3030 in the short term.

Ultimately, there is no scheduled major release from the United Kingdom for the rest of the day, except for the US ADP employment report and Preliminary GDP data. Both data has the potential to cause volatility for the GBP/USD and has the chance to push the pair touch the 1.30 mark. |

|   | | Andrea ForexMart

Senior Member

Posts : 216

Join date : 2017-08-23

|  Subject: Daily Market Analysis from ForexMart Subject: Daily Market Analysis from ForexMart  Tue Sep 05, 2017 7:58 am Tue Sep 05, 2017 7:58 am | |

EUR/USD Technical Analysis: September 4, 2017

The manufacturing data has exceeded predictions which countered the weak U.S. jobs data sustaining the range of the dollar on Friday prior to the long weekend holiday in the United States. The seasonally adjusted jobs data that propelled much lower expectations yet an increase of 156,000 was much more serious than anticipated. The European Central Bank speech implies that inflationary targets have not been attained that impedes the movement of the currency pair.

The euro against the U.S. dollar rose after the weakened U.S. jobs data but declined soon-after. It maintained an uptrend ahead of the support region close to the 10-day moving average at 1.1860. The resistance of the currency pair was set as the weekly highs at 1.2070 region. There is no momentum while the price rate is moving higher at a slower pace. Thus, the MACD histogram was almost zero-index level with a flat course that results to a consolidation. |

|   | | Andrea ForexMart

Senior Member

Posts : 216

Join date : 2017-08-23

|  Subject: Daily Market Analysis from ForexMart Subject: Daily Market Analysis from ForexMart  Wed Sep 06, 2017 8:40 am Wed Sep 06, 2017 8:40 am | |

GBP/USD Technical Analysis: September 5, 2017

Primarily, the sterling moved sideways on Monday, however, drove downwards to find some support and in order to make a rebound. The United States is currently in a holiday to celebrate the Labor Day, hence, the trading volume will be heightened during the European session.

Moreover, the market is having some conflicting pressure while players lack confidence about the possible increase of the Fed interest rates for this year. However, there are various concerns regarding the British exit from the European Union.

It is possible that the market will continue its choppiness which suggests to better trade in small positions. We should search for some pullback while the market should push lower touching the 1.2850 in the longer term. The 1.30 region appeared to be really resistive but when the 1.3050 area will be broken, buyers would likely take the driver’s seat once again.

It is expected that the market will keep on having some noise, but there is also a possibility that the market is seeking for clarity which is hard to look for because of the increasing noise in the markets.

It should be noted that the liquidity will not raise until the following week, considering that majority of the traders are not present due to the holiday. |

|   | | Andrea ForexMart

Senior Member

Posts : 216

Join date : 2017-08-23

| |   | | Andrea ForexMart

Senior Member

Posts : 216

Join date : 2017-08-23

|  Subject: Daily Market Analysis from ForexMart Subject: Daily Market Analysis from ForexMart  Thu Sep 07, 2017 1:12 pm Thu Sep 07, 2017 1:12 pm | |

USD/JPY Fundamental Analysis: September 7, 2017

The U.S. dollar against the Japan yen was traded lower during the beginning of Wednesday session. Yet, the market has bounced off and almost kept the rate as it reached low levels at 108.441. For the week, the trading situation gives a similar outlook after the missile launch by North Korea over Japan.

The USD/JPY pair was seen positioning at 108.724 and declined by 0.078 or -0.07% at 10.21 GMT. The USD/JPY pair closed the session at 0.884 down by -0.81% on Tuesday.

The Forex pair dropped with the current tension with North Korea as well as the rhetorics from Fed speakers. Traders are getting anxious prior to the monetary policy decision of the European Central Bank on Thursday.

Investors keep on reacting to the happenings in the North Korea and the price movement of the safe haven assets. Moreover, the stock market compellingly suggests that traders are concerned with the minimal progress towards the lowering the threat of a nuclear war.

Traders have been anxious with the issue on North Korea especially since the next nuclear test will happen on Sunday. Across the globe, this act was being contradicted as the price movement in the stock market where more investors are being disappointed since there is lack of progress in controlling the situation.

The USD/JPY pair will most likely continue trading with the influence of the U.S. Treasury yields and opinion of investors. The price action of the U.S. Treasury yields which is supported by the economic data and Fed speakers. Reactions of investors are influenced by the geopolitical events about North Korea.

Some minor U.S. data such as Trade Balance, Final Services PMI and the Fed Beige Book and the major report on the ISM Non-Manufacturing PMI will be released on Wednesday. The anticipated figure will be 55.8 and increased from 53.9.

The whole report may not be that relevant and move the pair. Also, the investors will center its attention on North Korea since this is unpredictable. Fears of uncertainty are reflected for the first time with investors who are taking off setting positions in the stock a market and place the money in safe haven assets. Traders should monitor for another stock sell-off for today. |

|   | | Andrea ForexMart

Senior Member

Posts : 216

Join date : 2017-08-23

|  Subject: Daily Market Analysis from ForexMart Subject: Daily Market Analysis from ForexMart  Fri Sep 08, 2017 12:28 pm Fri Sep 08, 2017 12:28 pm | |

USD/JPY Technical Analysis: September 8, 2017

The US dollar weakened versus the safe-haven Japanese Yen amid Thursday’s session and tested the 108.50 handle. This level appeared to be an interesting area because it is the bottom of the longer-term consolidation. A close under this region of the daily candle will push the market downwards through the next major support hurdle, which is the level of 105 below.

Otherwise, when the market rebounded from that point, then it is possible to return to the 109.50 mark. It will take some time for the market to declare their targets and we are currently at a very significant region on the longer-term charts. |

|   | | Andrea ForexMart

Senior Member

Posts : 216

Join date : 2017-08-23

|  Subject: Daily Market Analysis from ForexMart Subject: Daily Market Analysis from ForexMart  Mon Sep 11, 2017 11:52 am Mon Sep 11, 2017 11:52 am | |

USD/JPY Technical Analysis: September 11, 2017

The U.S. dollar against the Japanese yen had a significant breakdown during the Friday session. Nevertheless, the market proceeds to move downward and a breakdown lower than 108.0 level gives a negative outlook. Hence, this could lead to a further decline and even lower than the 105 level. This gives a very pessimistic outlook and the concept of the Federal Reserve in not raising its interest rates for short-term would persist to have an effect on the market. It is next to monitor the equities which would also influence the next movement of the pair. |

|   | | Andrea ForexMart

Senior Member

Posts : 216

Join date : 2017-08-23

|  Subject: Daily Market Analysis from ForexMart Subject: Daily Market Analysis from ForexMart  Wed Sep 13, 2017 11:56 am Wed Sep 13, 2017 11:56 am | |

EUR/USD Technical Analysis: September 13, 2017

European yields increased again together with the stabilization of risk appetite and revival of the global stock market that keeps buoying the EURUSD pair.

Eurozone peripherals had performed better while the European Central Bank assures for a cautious move as it prepares to ease off the stimulator. Meanwhile, the chain store sales of the United States declined after the destructive hurricanes Harvey and Irma that are predicted to put pressure on the national figures for this week.

The German economic ministry anticipates slow growth in the H2, which implies that employment growth might curb sentiment.

The euro-dollar pair formed another Doji day showing the opening and closing level were at the same point reflecting an indecision. The support highlighted the 1.1937 level close to the 10-day moving average. While the resistance came in at 1.2092 near the September peaks.

The momentum is in the neutral position and the MACD (moving average convergence divergence) indicator prints around the zero index level linked with a flat trajectory that shows some consolidation. Moreover, the RSI (relative strength index) known to be a momentum oscillator that assesses the increasing or decreasing momentum. The index prints a reading of 59 in the middle of the neutral range, which also indicates further consolidation. |

|   | | Andrea ForexMart

Senior Member

Posts : 216

Join date : 2017-08-23

|  Subject: Daily Market Analysis from ForexMart Subject: Daily Market Analysis from ForexMart  Thu Sep 14, 2017 12:56 pm Thu Sep 14, 2017 12:56 pm | |

USD/JPY Technical Analysis: September 14, 2017

The U.S. dollar versus the Japanese yen rallied to the upper channel during the Wednesday session and there is an unabating buying pressure. The discussion on tax reform from the United States further worsens the situation since it came out earlier than expected. On the other hand, this is favorable for the greenback. This makes more U.S. companies more aggressive and in all likelihood boost the U.S. economy. On this condition, it is presumed that buyers will enter the market and attain the level of 111. If the market successfully breaks out, there is a potential for the price to move much higher. |

|   | | Andrea ForexMart

Senior Member

Posts : 216

Join date : 2017-08-23

|  Subject: Daily Market Analysis from ForexMart Subject: Daily Market Analysis from ForexMart  Fri Sep 15, 2017 1:41 pm Fri Sep 15, 2017 1:41 pm | |

GBP/JPY Technical Analysis: September 15, 2017

The British pound moves sideways during the beginning of the Thursday session. This surged to the upper channel after the Bank of England hinted that there will be interest rate hikes soon.

Hence, the market will most likely proceed with buying on the lows and it may not be wise to short this pair for now. For long-term, the pair will try to reach the 150 handle and above. Selling will be difficult for this pair and the 145-level or lower will continue to support the market which gives a bit of a bullish pressure. |

|   | | Andrea ForexMart

Senior Member

Posts : 216

Join date : 2017-08-23

|  Subject: Daily Market Analysis from ForexMart Subject: Daily Market Analysis from ForexMart  Tue Sep 19, 2017 2:17 pm Tue Sep 19, 2017 2:17 pm | |

EUR/USD Technical Analysis: September 19, 2017

The euro-dollar pair remained almost unchanged as it stayed in the level 1.1953 under the 10-day moving average. On the other hand, the inflation came in at 1.5% which is lower the 2% target of the European Central Bank. Now, traders’ attention was turned to the Fed Reserve meeting on September 19 and 20, but there is no any expectations for the meeting. Moreover, the Fed had mentioned some ways in managing the bond purchase program. Contrarily, the Bundesbank assumes that growth will slow down in the second half of the fiscal year.

The EURUSD consolidated prior the meeting of the Federal Reserve which is scheduled tomorrow. The pair’s support hit the 1.1834 mark which is seen around the lows of the previous week. The resistance highlighted the region 1.2092 around the highs last week.

The momentum maintained a negative stance while the MACD (moving average convergence divergence) indicator prints in the red with a descending trajectory, pointing to lower exchange rate. |

|   | | Andrea ForexMart

Senior Member

Posts : 216

Join date : 2017-08-23

|  Subject: Daily Market Analysis from ForexMart Subject: Daily Market Analysis from ForexMart  Wed Sep 20, 2017 12:03 pm Wed Sep 20, 2017 12:03 pm | |

EUR/USD Technical Analysis: September 20, 2017

The currency pair EUR/USD was able to make some slight improvement during the trading session yesterday, however, the pair resumed the consolidation prior the meeting of the Fed Reserve scheduled on Thursday.

The German Zew Investor confidence had increased which buoyed the euro-dollar pair, but the attention of the traders are centered towards the Federal Reserve. When they mentioned about quantitative tightening during the meeting, it would likely that the U.S. import prices will rise more than 2% year over year.

The EURUSD remained to sit on the 10-day moving average, and continued consolidating before the Fed meeting tomorrow. The pair’s support touched the 1.1834 level around the lows last week. On one side, the resistance entered the 1.2092 region near the highs of the previous week.

Moreover, prices seem to generate a bull flag formation serves a pause that refreshes upwards. The negative momentum is moving downwards while the MACD (moving average convergence divergence) index is printing in the red showing an ascending trajectory that reflects for further consolidation. |

|   | | Andrea ForexMart

Senior Member

Posts : 216

Join date : 2017-08-23

|  Subject: Daily Market Analysis from ForexMart Subject: Daily Market Analysis from ForexMart  Thu Sep 21, 2017 11:43 am Thu Sep 21, 2017 11:43 am | |

EUR/USD Technical Analysis: September 21, 2017

The EURUSD trailed downwards during Wednesday's trading session after the release of Federal Research report as the central bank maintained interest rates. Moreover, the Fed Reserve announced that they progress with the quantitative tightening with an amount of 600 billion approximately, which is related to balance sheet reduction every year.

The FOMC also mentioned another rate increase scheduled presumably in December. Among 16 Fed members, there are 11 who voted for a hike this year. According to forecasts made by the officials, it might extend until next year to attain the neutral rate level of Fed funds. The Federal Reserve System gradually approach the issue about the three-time hike in 2019 and 2020 and the long-term rate was lowered down to 2.75%, with the previously 3.0%.

The euro-dollar pair weakened after the dollar made some progress along with the increase of yields. The support lies at 1.1834 region around the lows last week while resistance can be found at 1.2092 level near the previous highs.

The RSI (relative strength index) which functions as a momentum oscillator measuring the performance of the momentum, whether it will accelerate or decelerate. The indicator broke the support which shows an ascending negative momentum. On the other hand, the MACD histogram prints in the red, reflecting a downward trajectory that leads to a lower exchange rate. |

|   | | Andrea ForexMart

Senior Member

Posts : 216

Join date : 2017-08-23

|  Subject: Daily Market Analysis from ForexMart Subject: Daily Market Analysis from ForexMart  Fri Sep 22, 2017 10:36 am Fri Sep 22, 2017 10:36 am | |

EUR/USD Fundamental Analysis: September 22, 2017

The EUR/USD had a mixed performance during the daytime trading on Thursday, showing some choppiness without any hints on how to handle the dollar recovery. It happened after the FOMC meeting in which the Federal Reserve did not exclude chances for a rate increase in December and decided to begin the program to cut balance sheets. These combined announcements enabled to maintain the bid under the greenbacks, however, the trend of the EURUSD pair remained choppy to a certain extent.

Moreover, the single European currency weakened and moved below the 1.19 mark during the morning session, afterward, it started to recover and moved upwards since the US dollar weakened again over other selected currencies. With this, the euro was able to drive higher than the 1.19 level and currently trading in the 1.2950 area which continues to gain strength. It appeared that the pair would retrace its losses in the near term while the dollar bulls still having a tough time to generate strength recovery.

The USD failed to become well-composed in the past couple of days, as it loses its bullish gains. While the EUR successfully recovered due to the discussion about the continuous QE tapering in the market which is very visible to everyone.

In the near term, the euro is expected to remain in the bid as the pair test the range highs at 1.2070. The time for the dollar has not happened yet, therefore, bulls should be willing to wait for strong signals sent by the Fed regarding the rate hike, together with the ECB’s tapering talk and from that, we could expect for a reversal of fortune.

Ultimately, there are no major economic releases for today except the speech of ECB President Mario Draghi which is anticipated during London hours. According to forecasts, Draghi will tackle about the monetary policy while the market is still searching for some insights about tapering, however, the ECB president is known for his inclination not to touch the monetary policy during this kind of meetings. Furthermore, it remains unclear if this will brought an impact towards the euro-dollar pair. |

|   | | Andrea ForexMart

Senior Member

Posts : 216

Join date : 2017-08-23

| |   | | Andrea ForexMart

Senior Member

Posts : 216

Join date : 2017-08-23

|  Subject: Daily Market Analysis from ForexMart Subject: Daily Market Analysis from ForexMart  Wed Sep 27, 2017 1:34 pm Wed Sep 27, 2017 1:34 pm | |

GBP/USD Fundamental Analysis: September 27, 2017

The British pound has been competing with the surge of the dollar and a basket of currencies is already behind of the currency. The performance of the British currency has been better than other currencies as reflected in the past few weeks as it was supported by the Bank of England and the U.K. government which keeps it from collapsing.

The central bank supports the currency which allows the probability of a rate hike for the year. It seems that the bank would not disturb the economy with the ongoing process of Brexit that flows at a faster pace than in their last meeting. Although, they noted that they would interfere when necessary. It has improved the confidence of the U.K. economy which also pushes the currency at a slower but steady in the past few weeks.

The U.K. government aptly proceeds with the Brexit process through their parliament which helped the situation and supported the pound to rise stronger over time. Although the U.K. Prime Minister May lengthened the timeline for Brexit in the new few years. In the meantime, her approach implies that the both the nation and the investors trust the economy.

Today, there is no major economic news from the U.K. anticipated but the durable goods data will be released from the U.S. The greenback is presumed to hold the current rates because of the expected announcement in the afternoon from Trump to implement a new tax system. Consequently, the GBP/USD pair will be put under pressure. |

|   | | Andrea ForexMart

Senior Member

Posts : 216

Join date : 2017-08-23

|  Subject: Daily Market Analysis from ForexMart Subject: Daily Market Analysis from ForexMart  Thu Sep 28, 2017 3:09 pm Thu Sep 28, 2017 3:09 pm | |

EUR/USD Fundamental Analysis: September 28 2017

The Euro against the U.S. dollar persisted during yesterday session. It bounces off by just a few levels and it seems that the market did not pick up the momentum until it gets more conspicuous. Although, there are still evident signs of a rebound in the beginning of the trend.

There is a prediction for a rebound when the EUR/USD pair fails to break the 1.2070 area with certainty. The market has tried to break this level several times but they were unsuccessful up to now. The changes in the upcoming data are significant such as the CPI as this would reflect the performance in the previous months while the dollar needs a complete rebound which was supported by the Fed. Hence, the traders should be heedful about this.

Fed supported the trend following the FOMC announcement as there is a tendency for a rate hike in the last month of the year if the outcome of the data is positive. This is what the dollar bulls are looking for as they have been active for some time now. Currently, the euro is at an important support level and a rebound is anticipated while the dollar weakens for short-term to move it back higher than the 1.18 level.

There is no major news from the eurozone scheduled for today. On the other hand, the final GDP from the U.S. should be monitored by traders since this could cause some volatility. A strong surge of data would cause the dollar to proceed with its rebound then lower the pair towards 1.17 level. |

|   | | Andrea ForexMart

Senior Member

Posts : 216

Join date : 2017-08-23

|  Subject: Daily Market Analysis from ForexMart Subject: Daily Market Analysis from ForexMart  Mon Oct 02, 2017 1:27 pm Mon Oct 02, 2017 1:27 pm | |

GBP/USD Fundamental Analysis: October 2, 2017

The GBP/USD pair showed some choppiness in the past couple of days without any definite direction. The British pound was able to recover in the previous weeks, considering the fact that it is one of the strongest currency in the market. However, the Sterling was also affected by the dollar buying, forcing the Cable pair for a correction over the 1.35 level to trade beneath the 1.34 region in the past few days. Previously, the pound-dollar pair failed to broke the 1.3420 area after certain attempts which the pair did during the USD weakening.

In case that this pattern keep on going, it would likely cause further weakness in the GBP and could push the pair downwards. Moreover, we are waiting for a bundle of data from the United States later this week, which could possibly manage the greenback well bid in the near-term. These events when combined would likely place the sterling in the pressured area in the short-term.

On one side, the sterling pound was supported by the Bank of England (BOE), as the bank did not lose the possibility for a rate hike despite the ongoing Brexit process. Primarily, the market expected that the BoE will remain quiet during this kind of precarious scenario but the most recent meeting of the UK central bank clearly announced that they will only take action if necessary. This has provided support to the GBP, considering that British government showed optimistic views regarding the retention of the free market access to the European Union.

Ultimately, the manufacturing PMI data from the United Kingdom and the United States which could probably enough volatility. While it is essential for the bulls to break 1.3420 mark in the near-term for the completion of an upward trend. |

|   | | Andrea ForexMart

Senior Member

Posts : 216

Join date : 2017-08-23

|  Subject: Daily Market Analysis from ForexMart Subject: Daily Market Analysis from ForexMart  Tue Oct 03, 2017 2:45 pm Tue Oct 03, 2017 2:45 pm | |

GBP/USD Fundamental Analysis: October 3, 2017

The British pound against the U.S. dollar pair had a high volatility at times. A few days back, the bulls were dominating the market and various resistance levels were surpassed. This was supported by a strong data from the U.K. and moves from the both the Bank of England and the government of U.K. which further supported the British pound. This kept the pound afloat amid the uncertainty brought by the Brexit process and pushed the currency even much higher.

Last week, the pound is undergoing correction at a faster rate in reaction to the good performance in the past few weeks. The U.K. prime minister is saying that she anticipates the Brexit will be settled after a few more years which is not what the market is expecting whilst majority expects to it materialize sooner. There are also speculations that the government spearheaded by the Prime minister Theresa May will eventually collapse.

On the other hand, the Bank of England is uncertain on deciding its next move. Moreover, it seems that the data from the U.K. is also sliding down in the past few weeks with the manufacturing data from the UK yesterday clearly depicting that. This resulted in a decline of the GBP/USD pair and dropped more than 120 pips during the day while the dollar rallied dominating the market.

For today, the construction PMI data from the UK will be released but there’ll be no major data coming from the U.S. The dollar will continue to rise but poses a threat to change the trend. At the same time, this will keep the GBP/USD under pressure for the day as the market wait for a larger data to come out later in the week. |

|   | | Andrea ForexMart

Senior Member

Posts : 216

Join date : 2017-08-23

|  Subject: Daily Market Analysis from ForexMart Subject: Daily Market Analysis from ForexMart  Wed Oct 04, 2017 12:46 pm Wed Oct 04, 2017 12:46 pm | |

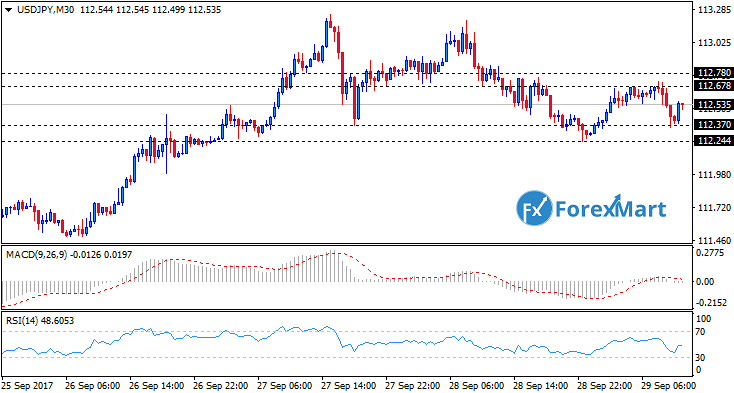

USD/JPY Technical Analysis: October 4, 2017The U.S. dollar against the Japanese yen surged but then it declined towards the level of 113.25. It declined to the area of 112.75 with a bit of support. Hence, the market will attempt to rally from this level and resume the general uptrend recently. After some time, the price will further move up due to the risk of appetite from traders. Moreover, there is a possibility for the Federal Reserve to increase its rates or at least the be stricter with the monetary policy. Therefore, the market will move towards the 113.25 level then towards 114.50 and higher. The market will test the peak of the whole consolidation which sways to and fro. If the market successfully breaks higher than the 115 handle, the market would move much higher which is presumably towards 118 level.If the price pullbacks from the said level, there would be more opportunities present to resume the value. It seems that the 112 will be largely supportive and the floor of consolidation will be seen at the level of 108. A pullback would open buying opportunities considering the support below. Eventually, both sellers and buyers will gain profits with the presence of volatility in the market if given sufficient time.Notably, the market is influenced by the general stock market which is another indicator that must be monitored besides the S&P 500 and the DAX etc. Nevertheless, the stock market will climb higher as it is in a good condition.

|

|   | | Andrea ForexMart

Senior Member

Posts : 216

Join date : 2017-08-23

|  Subject: Daily Market Analysis from ForexMart Subject: Daily Market Analysis from ForexMart  Tue Oct 10, 2017 12:51 pm Tue Oct 10, 2017 12:51 pm | |

NZD/USD Technical Analysis: October 10, 2017

There is volatility present in trading the NZD/USD pair as it reached a lower limit in the opening on Monday where this will be reversed and fill the gap and proceed with a decline again. There is a possibility for this to reach the level of 0.70 where there will most likely be a support level. This area has been supportive in the past which was also resistive and anticipates volatility around that number. Take into consideration that the New Zealand is highly sensitive to commodities as well as the global risk appetite. It can be noted that the stock market is performing well although, there is less liquidity in the New Zealand dollar compared to other currencies. Hence, there will most likely be more volatility than other markets.

It underwent a downtrend in the past few days which signifies the continuation of a bearish pressure. It’s too early to say if the market will break lower than 0.70 region and if it does, this would not be a good sign. Hereinafter, the market will look for the 0.68 level below as the next target support level based on the long-term charts. Moreover, the Australian dollar is dropping which usually moves in the similar direction as the New Zealand dollar. It will either move up or be sold unless a breakout happens higher than the 0.7125 region and look at higher levels which is most likely above the 0.72 level. Volatility will not be surprising in this pair and seller will consider the riskier currencies in the present. |

|   | | Sponsored content

|  Subject: Re: Daily Market Analysis from ForexMart Subject: Re: Daily Market Analysis from ForexMart  | |

|

|   | | | | Daily Market Analysis from ForexMart |    |

|

Similar topics |  |

|

| | Permissions in this forum: | You cannot reply to topics in this forum

| |

| |

| |